Alabama Real Estate and Local Tax Rates: A Guide for Buyers, Sellers, and Investors

Contents

Overview of Alabama Taxation

Alabama has a multi-layered tax structure that affects real estate buyers, investors, and residents. Taxes are levied at both the state and local level, including:

- Sales Tax – applied on retail transactions and services.

- Real Property Tax – based on market value and millage rates of real estate.

- Personal Property Tax – for movable assets like vehicles or business equipment.

What is the Sales Tax Rate in Alabama?

The base state sales tax in Alabama is 4%. However, counties and municipalities may impose additional local sales tax rates. The resulting total sales tax varies by location and can exceed 10% in some cities.

Sales Tax Structure

- State Tax: 4%

- County Tax: Ranges from 1% to 3%

- Municipal Tax: Ranges from 0% to 5%

Example: Sales Tax in Athens, AL

In Athens, Limestone County:

State Tax = 4.0% County Tax = 2.0% Municipal Tax = 3.0% ------------------------ Total Sales Tax = 9.0%

Real Property Tax Explained

Alabama real property tax is calculated using assessed value and millage rates:

- Market Value: What the property is worth on the open market

- Assessment Ratio: 10% for residential, 20% for commercial, 30% for utilities

- Assessed Value: Market Value × Assessment Ratio

- Millage Rate: Tax rate per $1,000 of assessed value

Example: Residential Property in Athens, AL

Home Market Value: $250,000

Assessment Ratio (Residential): 10% Assessed Value: 250,000 × 0.10 = $25,000 Millage Rates: State Millage: 6.5 County Millage: 13.5 School Millage: 18.0 Municipal (Athens): 15.0 ------------------------------------------------ Total Millage Rate: 53.0 mills Annual Property Tax: = (25,000 × 53.0) / 1000 = $1,325.00

Millage rates vary by county and municipality. Always verify current rates using the latest Alabama Department of Revenue documents.

Personal Property Tax (Vehicles & Equipment)

Vehicles and business personal property are taxed annually based on depreciated value:

- Vehicles: Tax paid during registration/renewal; value based on ALDOR Motor Vehicle Valuation Manual

- Business Equipment: Reported annually and depreciated using DOR schedules

- Assessment Ratios: Often 20% for Class II personal property

Example: Vehicle Tax Calculation

2020 SUV depreciated value: $20,000

Assessment Ratio: 20% Assessed Value: 20,000 × 0.20 = $4,000 Millage Rate (example): 60 mills Annual Personal Property Tax: = (4,000 × 60) / 1000 = $240.00

Taxes are due at registration and vary by location. Counties apply their own millage on personal property.

Formatted Calculation Examples

Residential vs Commercial Property Tax

Compare taxes between two classes of property using the same market value:

Market Value: $500,000

Class II (Residential):

Assessment Ratio: 10% → Assessed Value: $50,000

Millage Rate: 53 → Tax: (50,000 × 53) / 1000 = $2,650

Class III (Commercial):

Assessment Ratio: 20% → Assessed Value: $100,000

Millage Rate: 53 → Tax: (100,000 × 53) / 1000 = $5,300

Authoritative References

- Alabama Department of Revenue (ADOR)

- ADOR Property Tax Division

- Motor Vehicle Valuation Manual

- Sales & Use Tax Division

- County-level millage rate publications (latest PDF:

MILLS23_edFM.pdf)

Need Help Calculating Your Local Taxes?

(Coming Soon) Use our integrated tool to calculate estimated sales and property taxes by address. Reach out to a local real estate or tax professional for further support.

Want Personalized Real Estate Help?

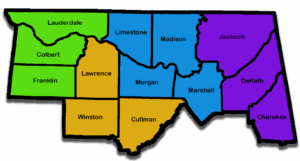

Thinking about buying a home in Northern Alabama? Connect with Jessica Hassan, a local real estate agent specializing in relocation. Contact me, I can help you find the best fit for your family! Ready to explore homes that fit your lifestyle, commute, and budget? Search Huntsville homes now

#AlabamaTax #AlabamaPropertyTax #TaxRateEducation #AlabamaTaxRates #UnderstandingRealEstateTax

Sharing is Caring: